Red Flags to Double-Check Right Before Signing on the Dotted Line

Before making any commitments, it’s crucial to identify the red flags that could indicate potential pitfalls. This guide focuses on essential warning signs to watch for before signing on the dotted line.

Entering into any agreement, especially in business, requires a thorough examination of all aspects involved. From contracts to partnerships, the decision to sign on the dotted line can lead to significant consequences, both positive and negative. In this comprehensive guide, we will delve into the critical red flags that every entrepreneur and business owner should be aware of before sealing any deal. We will cover various aspects, including contractual obligations, financial implications, and the importance of transparency. Whether you are considering purchasing a pool route or entering into a new partnership, understanding these red flags will empower you to make informed decisions and avoid potential pitfalls.

Understanding the Scope of the Agreement

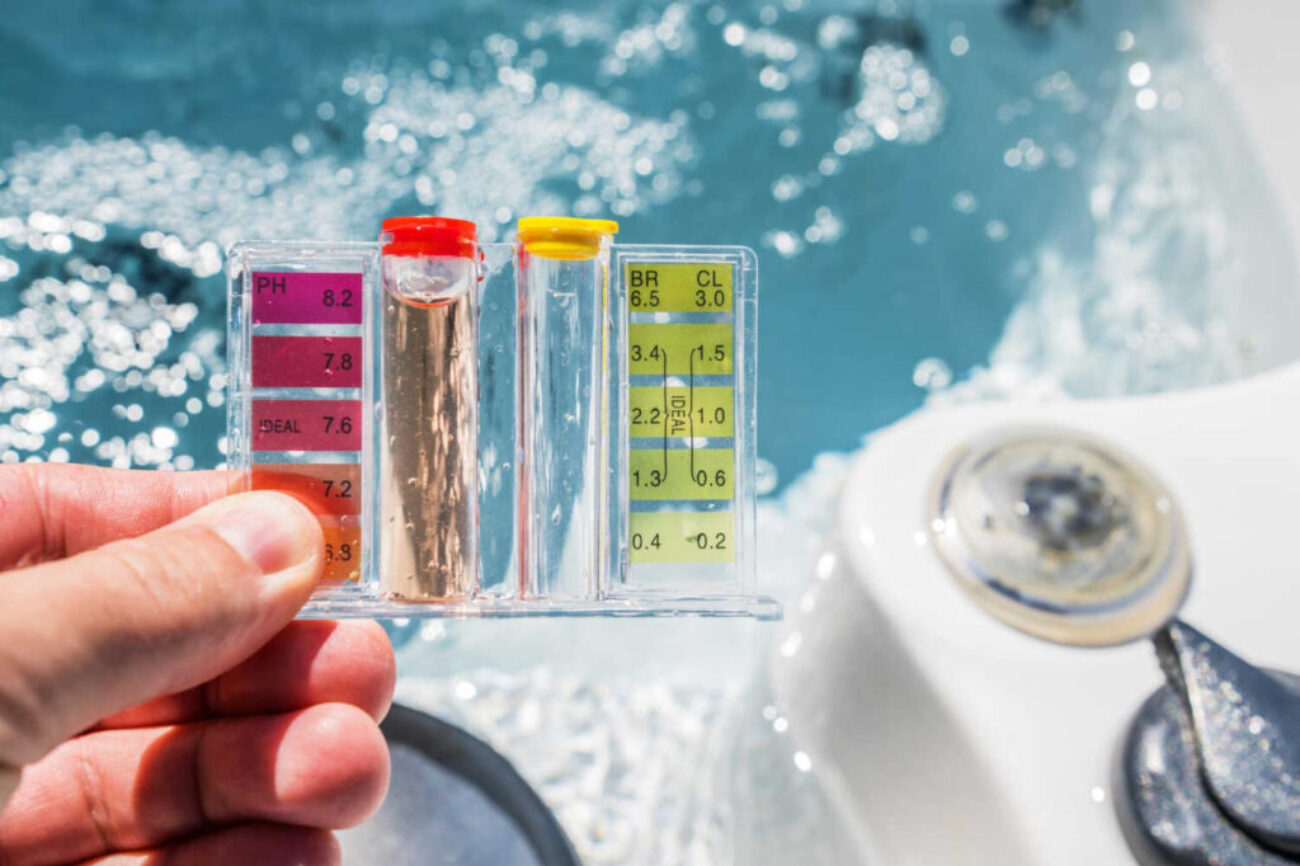

– One of the first red flags to watch out for is a vague or overly complex contract. If the terms of the agreement are unclear or difficult to understand, it’s essential to seek clarification. A well-structured agreement should outline the responsibilities, rights, and obligations of all parties involved. For instance, when purchasing pool routes for sale, ensure that the contract specifies the customer base, revenue expectations, and any maintenance obligations associated with the routes.- Additionally, be cautious if the seller is unwilling to provide documentation or evidence of the business’s operational performance. You should ask for financial statements, customer agreements, and any existing service contracts. If these documents are not readily available, it may indicate that the seller has something to hide or that the business may not be as profitable as it seems.

Financial Stability and Transparency

– Financial red flags can be alarm bells that indicate the health of the business in question. If you’re considering buying a pool route for sale, ensure that the seller provides transparent financial records. Look for consistent revenue streams and profitability over an extended period. If you notice significant fluctuations or losses in their financial reports, this could be a sign of instability.- Another critical aspect to consider is the seller’s willingness to discuss financial liabilities. If they are evasive about outstanding debts or obligations, it may indicate potential problems that you may inherit after the purchase. Always conduct a thorough due diligence process, involving an accountant or financial advisor, to assess the overall financial health of the business you are considering acquiring.

Legal Compliance and Regulatory Issues

– One significant red flag involves the legal compliance of the business. Before signing any agreement, ensure that the business adheres to all local, state, and federal regulations. For example, if you’re considering purchasing pool routes in Florida or Texas, ensure that the seller has all necessary licenses, permits, and insurances in place. Failure to comply with legal requirements could result in hefty fines or legal ramifications that you would have to face as the new owner.- Furthermore, check for any existing legal disputes involving the business. If the seller is reluctant to disclose any pending litigation or has a history of legal issues, this could be a considerable risk. Legal troubles can drain resources, impact reputation, and ultimately disrupt operations.

Assessing the Seller’s Reputation

– The reputation of the seller can significantly impact your decision. If you’re dealing with a pool business broker, research their track record and customer feedback. Look for reviews or testimonials that speak to their integrity and the quality of their services. If you come across multiple negative reviews or complaints about the broker, it might be wise to reconsider your options.- Additionally, ask for references from previous clients. Speaking directly with those who have engaged with the seller can provide invaluable insights into their business practices and customer service. A reputable broker, such as Tower Business Brokers, Inc., would have a history of satisfied clients and a transparent process for buying pool routes.

Negotiation Tactics and Pressure

– Be wary of high-pressure sales tactics. If the seller is pushing for a quick sale or trying to rush you into making a decision, it could be a red flag. A legitimate seller will be open to discussions and willing to address any concerns you may have. Take your time to evaluate the deal thoroughly, and don’t be afraid to walk away if something doesn’t feel right.- Furthermore, if the terms of the deal seem too good to be true, they often are. Conduct a market analysis to compare the offered price with similar pool routes for sale. If the price is significantly lower, it may be a reflection of underlying issues that should be investigated.

Hidden Fees and Costs

– Hidden fees can erode your profits and affect the overall value of the deal. Before signing, insist on a comprehensive breakdown of all costs associated with the purchase. This should include not only the purchase price but also additional costs such as maintenance fees, transition assistance fees, and any potential liabilities you may inherit.- In the context of purchasing a pool route, be sure to inquire about ongoing operational costs such as employee wages, equipment maintenance, and marketing expenses. Understanding the complete financial picture will help you determine whether the investment aligns with your financial goals.

Training and Support Availability

– An often-overlooked aspect is the availability of training and support after the purchase. If the seller or business broker is not willing to provide adequate training and support during the transition, this is a significant red flag. In the pool maintenance industry, having a solid understanding of the operational systems and customer management processes is essential for success.- Ensure that the purchase agreement includes provisions for ongoing support, especially if you are new to the pool service business. Comprehensive training can make a substantial difference in your ability to manage the newly acquired route effectively.

Comparative Analysis of Market Trends

– Understanding market trends in the pool maintenance industry, particularly in Florida and Texas, is essential. If the seller is dismissive of market dynamics or does not provide insight into how the route fits within current trends, it could signify a lack of commitment to transparency.- Conduct your research to identify whether the pool route is in a growing area, how competition influences pricing, and what opportunities for expansion exist. A reliable business broker should offer insights into market conditions, helping you make an informed decision.

Conclusion

– In summary, recognizing red flags before signing on the dotted line is crucial for any business transaction. From ensuring financial stability and legal compliance to assessing the seller’s reputation and understanding potential costs, each aspect plays a vital role in making an informed decision.- Always proceed with caution and seek expert advice when necessary. The right preparation and vigilance can help you navigate the complexities of buying a pool route, ultimately leading to a successful and profitable venture. If you’re looking for reliable pool routes for sale, consider reaching out to Tower Business Brokers to explore your options and empower your journey into pool route ownership. Don’t hesitate to contact us today to discuss your needs and find the perfect fit for your business aspirations.